Europe

beyond markets

EUROPE

BEYOND MARKETS

The euro was planned during a period in which economic policy making was driven by a deep belief in market liberalism and the near impossibility of systemic financial crises. This belief has been brought into question since the euro crisis, which showed that panics do happen. New thinking needs to focus on developing mechanisms to protect eurozone countries from such panics and to foster economic convergence between members.

LATEST NEWS

Lessons from the inflation shock: New Economy Short Cut with Jérôme Creel and Peter Bofinger

KNOWLEDGE BASE

EUROPE

BEYOND MARKETS

The Challenge

The ECB’s continuing program of bond purchases and its emergency lending to struggling banks show the underlying instability of the eurozone.

What Went Wrong

A deep belief in self-regulating markets and market-driven integration failed to lead to convergence. It instead led to divergence and major imbalances.

New Economy in Progress

New research focuses on the policies – macroeconomic, institutional and regulatory – needed to ensure convergence, prevent shocks and improve crisis management.

5 WAYS THAT ARE DISCUSSED TO STRENGTHEN EUROPE

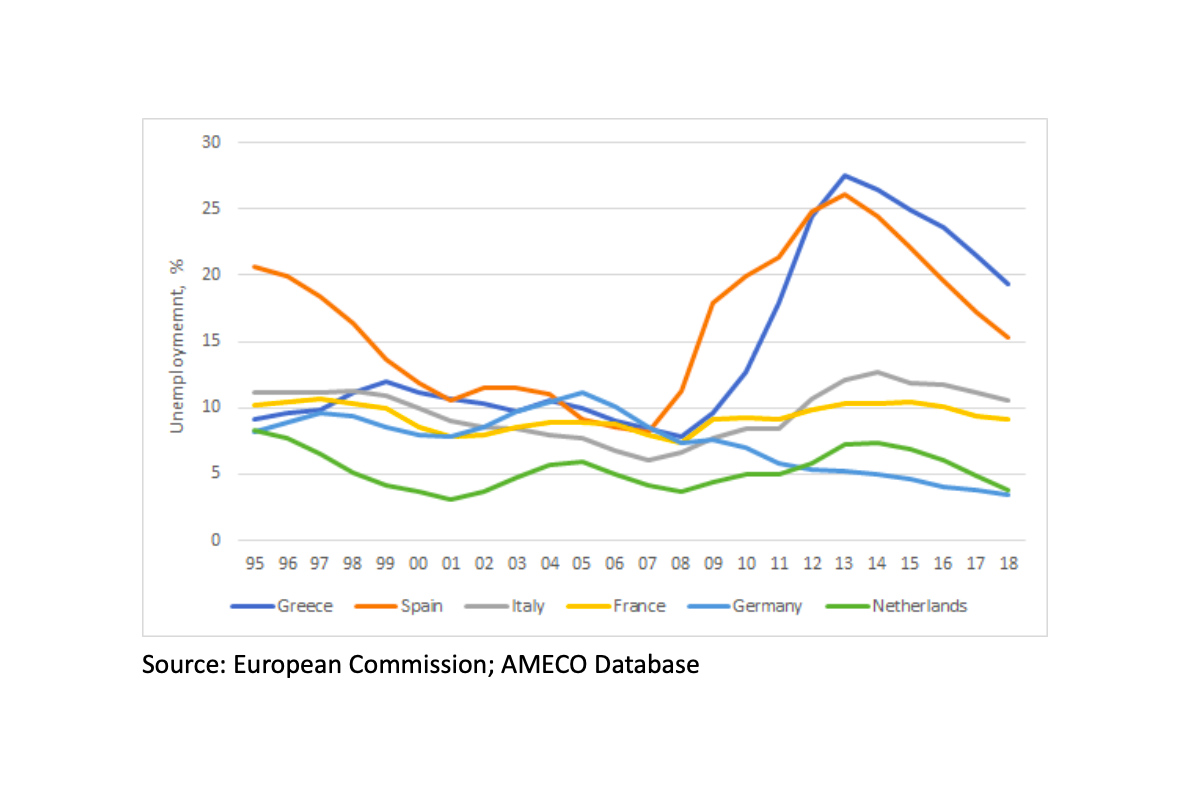

UNEMPLOYMENT RATES IN EUROPE (%, AVAILABLE WORKFORCE), 1995 - 2018

Lessons from the inflation shock: New Economy Short Cut with Jérôme Creel and Peter Bofinger

What could better EU debt rules look like? Short Cut with J. Zettelmeyer and A. Truger

For more than two years now, the EU debt rules have been suspended, which in the eyes of many critics had long been ineffective anyway. We spoke with Jeromin Zettelmeyer and Achim Truger about the latest reform proposals of the EU Commission and the Council of Economic Experts.

Short Cut on the Reform of EU Fiscal Rules With A. Truger and J. Zettelmeyer

What Would a Populist Government Mean for Italy and the Euro? Short Cut with Lucio Baccaro and Holger Schmieding

According to polls, Italians will elect a right-wing coalition in less than ten days. Would such a populist government lead Italy into a new debt crisis? We talked about this with Holger Schmieding and Lucio Baccaro.

What Would a Populist Government Mean for Italy and the Euro?

French Presidential Election - Will the Right Lose Because of Putin?

Cornelia Woll, Moritz Schularick, Anne-Laure Delatte and Shahin Vallée discussed this question in our New Economy Short Cut on April 1.

Towards new fiscal rules for the euro zone?

Prominent French economists around Macron have written a reform proposal for the European Stability and Growth Pact and have discussed it at the VIII. New Paradigm Workshop.

Preview: Should Germany issue perpetual bonds for European solidarity? - Discussion of the proposal by George Soros

On December 4 at 4 pm CET, INET and the Young Scholars Initiative will host a discussion on the future of European fiscal capacity.