Europe

beyond markets

EUROPE

BEYOND MARKETS

The euro was planned during a period in which economic policy making was driven by a deep belief in market liberalism and the near impossibility of systemic financial crises. This belief has been brought into question since the euro crisis, which showed that panics do happen. New thinking needs to focus on developing mechanisms to protect eurozone countries from such panics and to foster economic convergence between members.

LATEST NEWS

Lessons from the inflation shock: New Economy Short Cut with Jérôme Creel and Peter Bofinger

KNOWLEDGE BASE

EUROPE

BEYOND MARKETS

The Challenge

The ECB’s continuing program of bond purchases and its emergency lending to struggling banks show the underlying instability of the eurozone.

What Went Wrong

A deep belief in self-regulating markets and market-driven integration failed to lead to convergence. It instead led to divergence and major imbalances.

New Economy in Progress

New research focuses on the policies – macroeconomic, institutional and regulatory – needed to ensure convergence, prevent shocks and improve crisis management.

5 WAYS THAT ARE DISCUSSED TO STRENGTHEN EUROPE

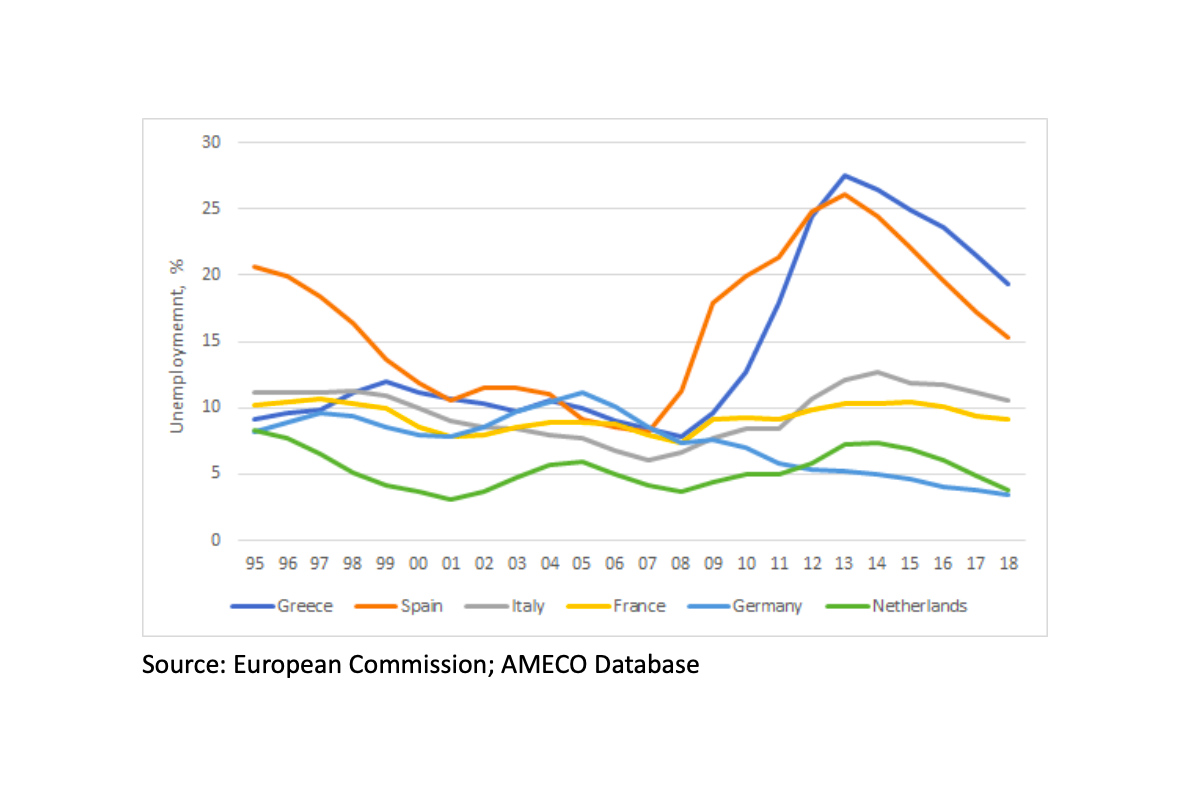

UNEMPLOYMENT RATES IN EUROPE (%, AVAILABLE WORKFORCE), 1995 - 2018

German-French alternative to Euro-Bonds

What's behind Merkel and Macron's 500 billion-dollar proposal. Our update on the reconstruction plans for Germany and Europe.

Forum Seminar: The Economics of the EU‘s Green Deal – Highlights

The EU’s Green Deal is one of the most ambitious EU endeavours to fight climate change. Nevertheless, it still needs more to be more impactful and tangible for people. This has been one of the main common insights of our seminar on the economics of the deal this week in Berlin.

The EU’s Green Deal – on its Macroeconomic Potential

The announcement of a Green Deal for Europe as introduced by the European Commission made huge headlines. Now there is a trillion Euro question to be answered. Is it in reality only a 7.5 billion Euro question? We try to bring clarity with this Framing Paper which we wrote to complement our Green Deal seminar hosted on the 18th of February.

Video: Carlo Jaeger – EU needs a new Innovation Strategy

The Green Deal as currently designed is a big chance but not enough. Carlo Jaeger (Global Climate Forum) advocates for more public investments and a redirection in the innovation strategy in Europe.

The proposed reform of the European Stability Mechanism must be postponed

Eurozone finance ministers reached a preliminary agreement on a reform of the European Stability Mechanism in June, but failed to conclude it last week. The reform is now set to be discussed during the European Council meeting on 12-13 December. Shahin Vallée, Jérémie Cohen-Setton, Paul De Grauwe and Sebastian Dullien write that the proposal should not be endorsed in its current form. They argue it would represent a missed opportunity to secure a broader and more ambitious reform package.

Mario Draghi’s farewell remarks

Mario Draghi, October 28th, 2019