Redefining

the role of

the state

REDEFINING

THE ROLE OF

THE STATE

For decades, there was a consensus that reducing the role of the state and cutting public debt would generate wealth. This contributed to a chronic underinvestment in education and public infrastructure. New research focuses on establishing when and how governments need to intervene to better contribute to long-term prosperity and to stabilize rather than aggravate economic fluctuations.

LATEST NEWS

Cutting Red Tape – But How? New Economy Short Cut with Patrick Bernau, Georg Diez and Johanna Sieben

KNOWLEDGE BASE

REDEFINING

THE ROLE OF

THE STATE

The Challenge

Decaying infrastructure and a lack of investment in education and innovation expose the weaknesses of an overly market-driven paradigm.

What went wrong

Reducing the role of the state in the economy was seen as the best way to ensure high levels of growth.

New Economy in Progress

The challenges of our time require us to rethink the role of the state and the need for a more active fiscal policy.

5 POSSIBLE WAYS THAT ARE DISCUSSED TO REDEFINE THE ROLE OF THE STATE

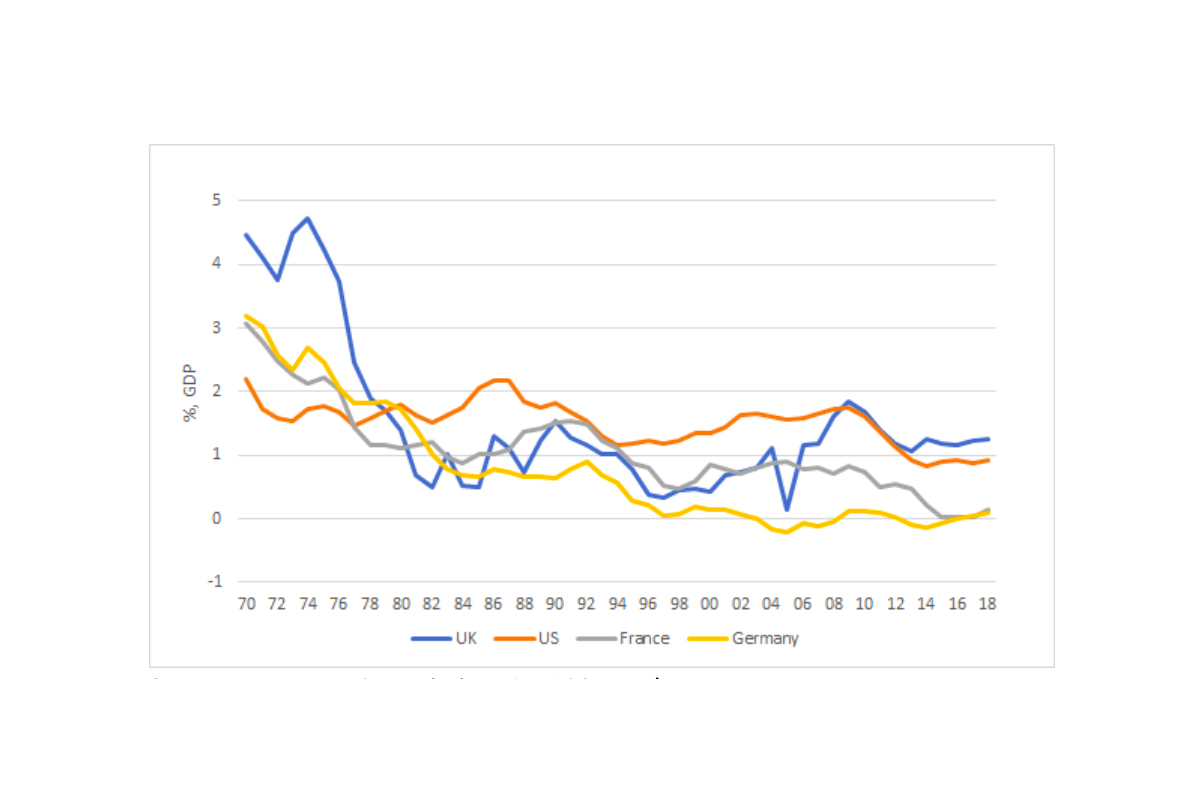

THE STEEP DECLINE IN NET PUBLIC INVESTMENT

New Roles for the State: Rethinking Government at the Turning of Ages

100 Billion for the Bundeswehr – A Turnaround in Fiscal Policy?

The German armed forces are to receive 100 billion - without violating the debt limits. What does this mean for the course of the Federal Minister of Finance? Will savings have to be made elsewhere? Watch the discussion with Sebastian Dullien, Jens Südekum, Hubertus Bardt and Philippa Sigl-Glöckner as re-live.

Annual Economic Report: Do We Now Measure Prosperity in Germany anew?

New Paradigm Knowledge Base – Update on the role of the state

What role should the state play in innovation policy? How can the infrastructure investments needed for climate protection be financed by the state? Does a socially acceptable implementation of the Green New Deal require the EU to relax its debt rules?

Election analysis: Scholz’s respect formula appealed to voters

Election narratives of the SPD candidate for chancellor with very high approval ratings among the population / Core statements in the CDU program significantly less popular / Analysis of a Civey survey commissioned by the Forum New Economy

Agenda for Germany's future finance minister

Fiscal policy trade-offs will be a key issue in Germany's coalition negotiations. From debt brakes to climate investments, what's facing the next government? That was the main question of a panel organized by NEF and Forum New Economy.