Greening

prosperity

GREENING

PROSPERITY

During the high point of market orthodoxy, economists argued that the most 'efficient' way to combat climate change was to simply let markets determine the price of carbon emissions. Today, there is a growing consensus that prices need to be regulated and that a carbon price on its own might not be enough.

LATEST NEWS

Climate policy in crisis – will better timing help with CO2 pricing?

KNOWLEDGE BASE

GREENING

PROSPERITY

The Challenge

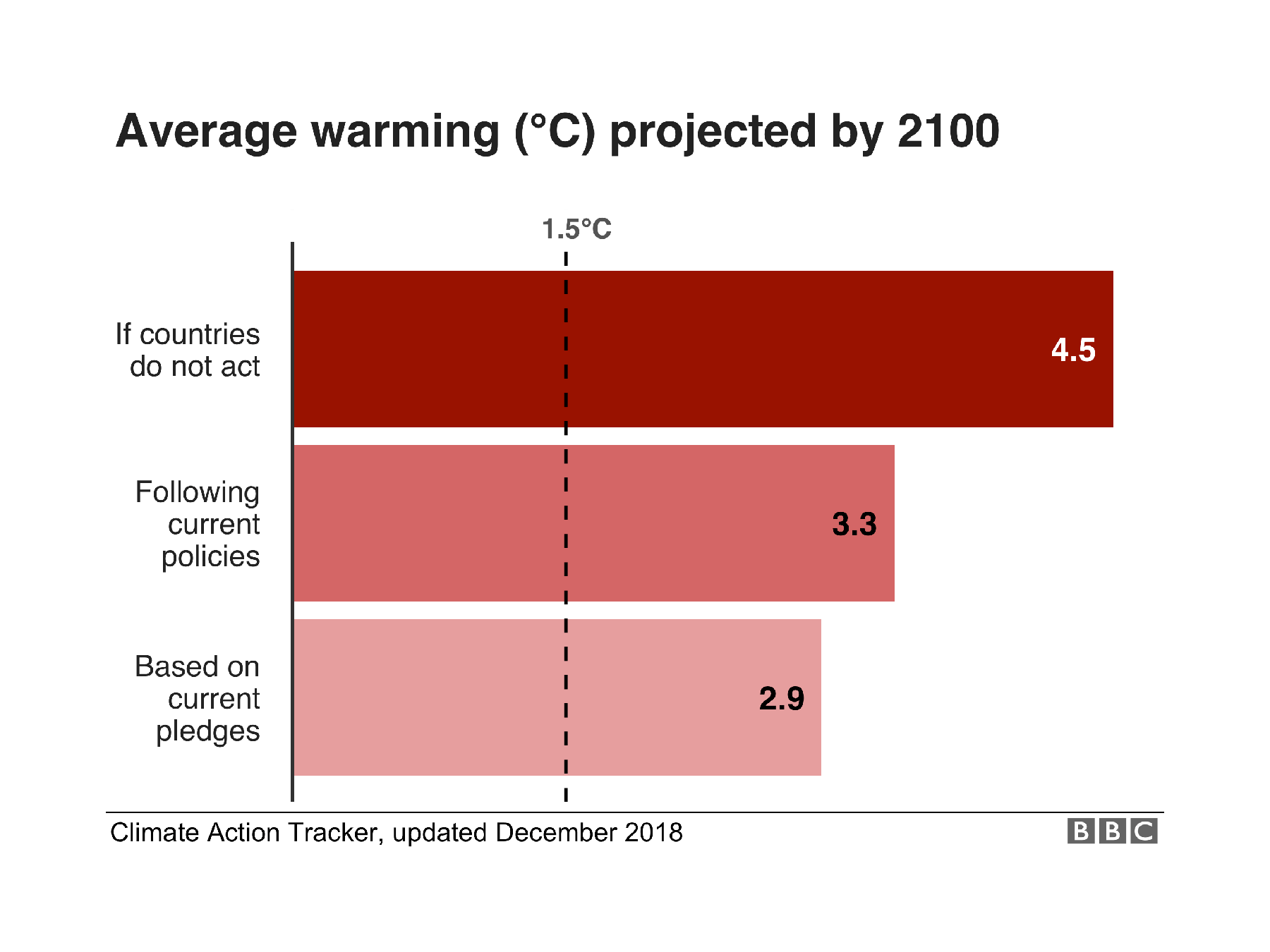

Global emissions of greenhouse gases are still rising rapidly and the window of opportunity to limit the increase in average global temperatures to less than 2 degrees is vanishingly small.

What Went Wrong

EU carbon prices have been far too low to stimulate investment in low carbon technologies and efforts to establish a global carbon market have largely failed.

New Economy in Progress

Putting a price on carbon will not in itself lead to a zero-carbon economy: it will require large-scale public action and investment to create the necessary markets and infrastructure.

5 WAYS THAT ARE DISCUSSED TO GREEN PROSPERITY

AVERAGE WARMING (°C) PROJECTED BY 2100

Climate Policy from a Keynesian Point of View

A new paper by J. W. Mason (City University of New York) emphasises the need for investment-centred instead of price-centred climate policy.

Coalition agreement 2021-2025: Additional financial leeway for future investments?

The coalition agreement is here. Do the targeted fiscal policy instruments allow sufficient leeway for the necessary climate and other investments in the future? Tom Krebs and Janek Steitz with an assessment.

Climate investment: How to finance the 2030 targets

An analysis by Agora Energiewende and Forum New Economy shows: Making use of smart fiscal policy, the new German government can finance the necessary climate protection measures despite a return to the debt brake.

2030 targets require tripling of climate protection investments

A study commissioned by Agora Energiewende and Forum New Economy shows that achieving a 65 percent reduction in greenhouse gas emissions by 2030 compared to 1990 would require climate protection investments to be up to three times higher than currently estimated.

Climate policy and the modern state: A hydrogen package for Germany

Green hydrogen is considered an essential component for the climate transition. A new study by Tom Krebs develops a modern hydrogen strategy for Germany.

Climate Challenge: Will Germany manage the transition?

The main question of the climate session on the VIII. New Paradigm Workshop was, how Germany can manage the transition to climate-neutrality by 2050 - or 2045.

Expert-Seminar - The transformation of the automobile industry in Germany

On 24 February, Forum New Economy organised an online expert seminar on the transformation of the automobile industry where the impact of the transport turnaround on car regions and employment was discussed.

Getting Real About A European Green Deal

By Carlo Jaeger and Sarah Wolf, Global Climate Forum, Potsdam University, presented at the Paris New Paradigm Initiative Workshop.

Shifting Paradigms in Carbon Pricing

By Ottmar Edenhofer, Brigitte Knopf et al., Mercator Research Institute for Climate Change