Remaking

finance

REMAKING

FINANCE

More than a decade after the financial crisis there still seems to be something seriously wrong with the financial system. Financial markets still tend to periodically misprice risk and contribute to boom and bust cycles. A better financial system needs to discourage short-termism and speculative activity, curtail systemic risk and distribute wealth more broadly.

LATEST NEWS

KNOWLEDGE BASE

REMAKING

FINANCE

The Challenge

The 2008 Global Financial Crisis was the worst economic crisis since the Great Depression and the world still suffers from systemic financial instability.

What Went Wrong

The efficient market hypothesis stipulated that bubbles could not exist and that the market is the best disciplining device.

New Economy in Progress

A better financial system needs to counter herding, booms and busts and the inherent tendency towards instability.

5 WAYS THAT ARE DISCUSSED TO REMAKE FINANCE

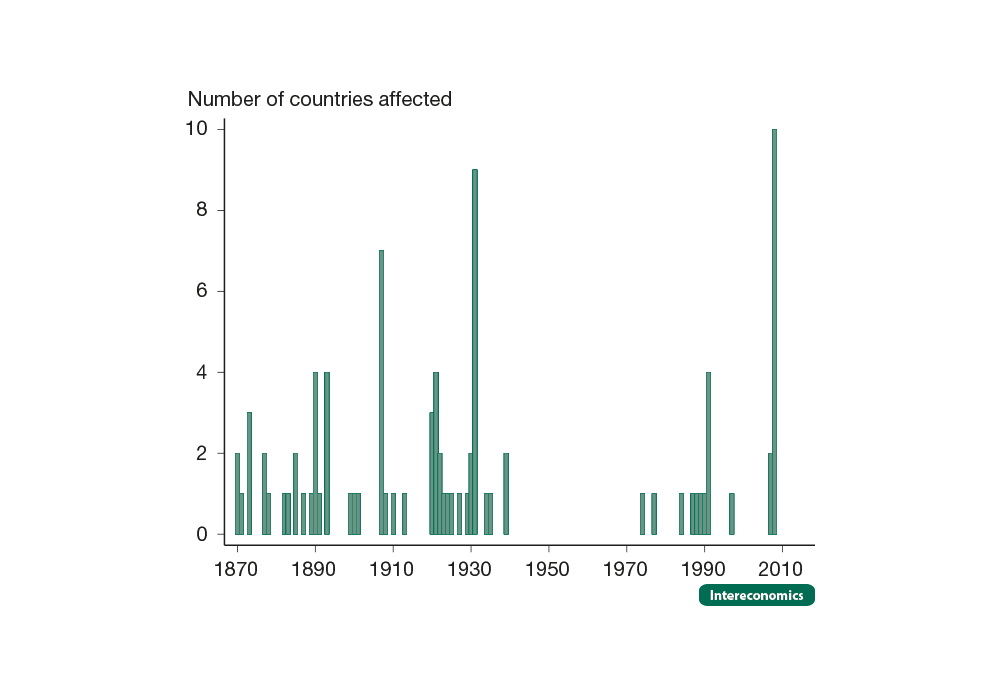

FINANCIAL CRISES IN ADVANCED ECONOMIES, 1870-2015

The Bankers‘ New Clothes with Martin Hellwig and Martin Wolf – Why Banks are Still Dangerous

New Economy Short Cut Re-live: Reducing Government Debt, But How?

Do austerity programs actually fulfill their purpose of reducing government debt? We discussed this with IMF economist Adrian Peralta-Alva, Achim Truger and Philippa Sigl-Glöckner on May 31.