Remaking

finance

REMAKING

FINANCE

More than a decade after the financial crisis there still seems to be something seriously wrong with the financial system. Financial markets still tend to periodically misprice risk and contribute to boom and bust cycles. A better financial system needs to discourage short-termism and speculative activity, curtail systemic risk and distribute wealth more broadly.

LATEST NEWS

The Bankers‘ New Clothes with Martin Hellwig and Martin Wolf – Why Banks are Still Dangerous

KNOWLEDGE BASE

REMAKING

FINANCE

The Challenge

The 2008 Global Financial Crisis was the worst economic crisis since the Great Depression and the world still suffers from systemic financial instability.

What Went Wrong

The efficient market hypothesis stipulated that bubbles could not exist and that the market is the best disciplining device.

New Economy in Progress

A better financial system needs to counter herding, booms and busts and the inherent tendency towards instability.

5 WAYS THAT ARE DISCUSSED TO REMAKE FINANCE

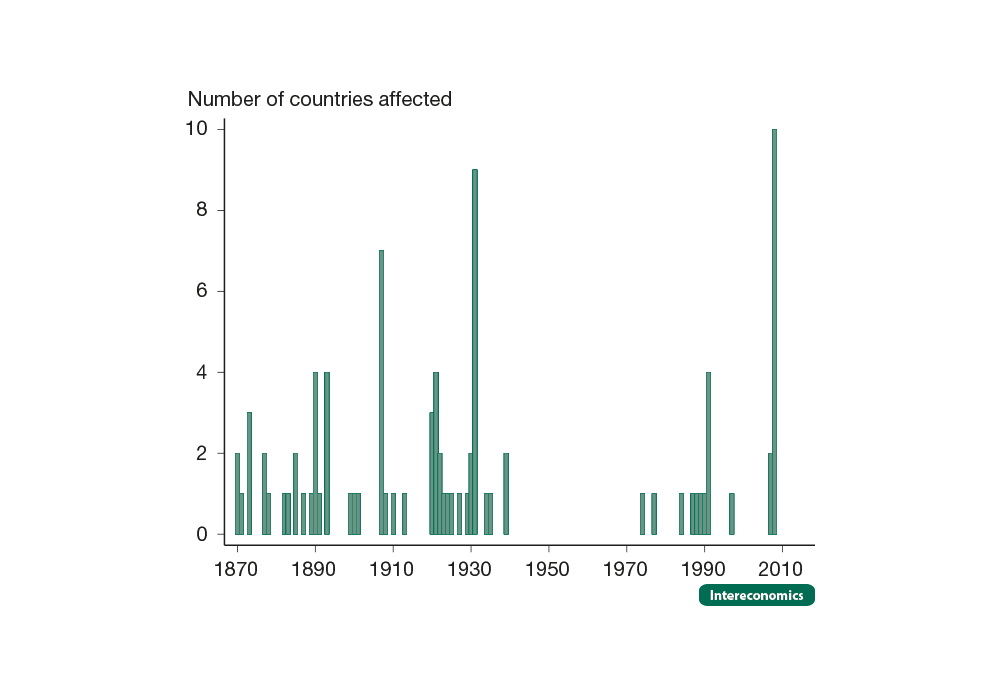

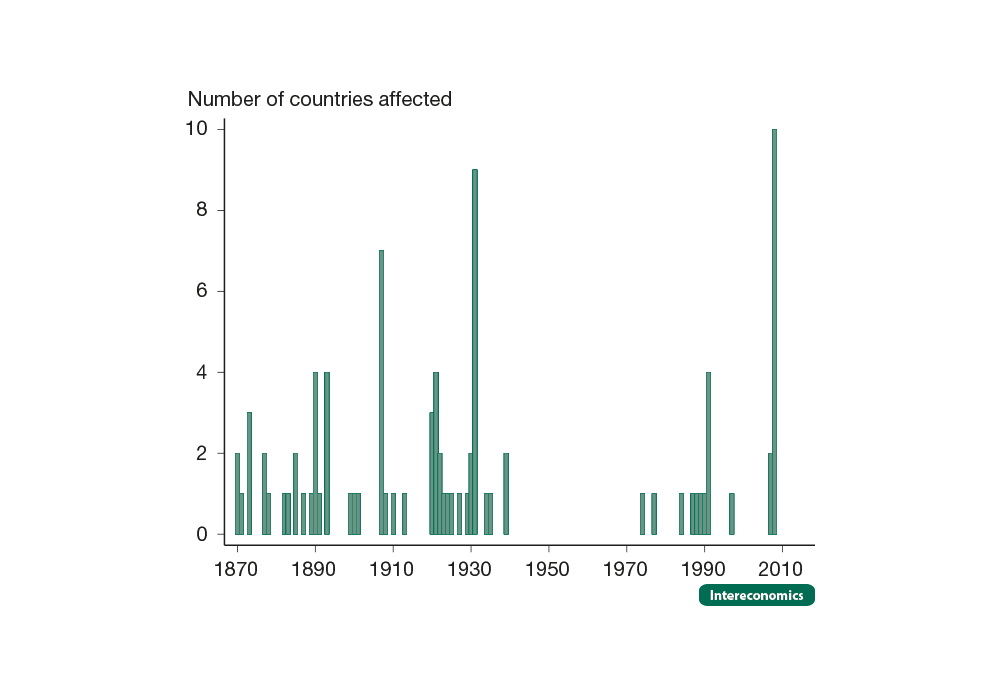

FINANCIAL CRISES IN ADVANCED ECONOMIES, 1870-2015

New Economy Short Cut & INET Debt Talk – Who’s Afraid of European Banks?

Join us for our ninth edition of the New Economy Short Cut, this time in partnership with the Institute for New Economic Thinking. With Martin Arnold, Elena Carletti and Richard Vague; moderated by Thomas Fricke and Moritz Schularick

The Conflict of Interest on the Financial Market in Europe

How far can policymakers stretch the mandate of the ECB? Right now the central bank seems to be the institution burdened with organizing European solidarity. Erik Jones gives a detailed look into the current developments and explains how the banking sector functions.

IfW Kiel on the EU Financial Transaction Tax: “Instrument suitable, proposed implementation flawed”

According to a recent German-French proposal, a financial market transaction tax (FTT) on the purchase of securities is to be introduced in 10 EU countries. In their study, the authors of the Kiel institute for the world economy compare this proposal in an international perspective and develop policy recommendations.

Towards a New Paradigm: Stabilizing Financial Markets

By Moritz Schularick and Kaspar Zimmermann, University of Bonn