Greening

prosperity

GREENING

PROSPERITY

During the high point of market orthodoxy, economists argued that the most 'efficient' way to combat climate change was to simply let markets determine the price of carbon emissions. Today, there is a growing consensus that prices need to be regulated and that a carbon price on its own might not be enough.

LATEST NEWS

Climate policy in crisis – will better timing help with CO2 pricing?

KNOWLEDGE BASE

GREENING

PROSPERITY

The Challenge

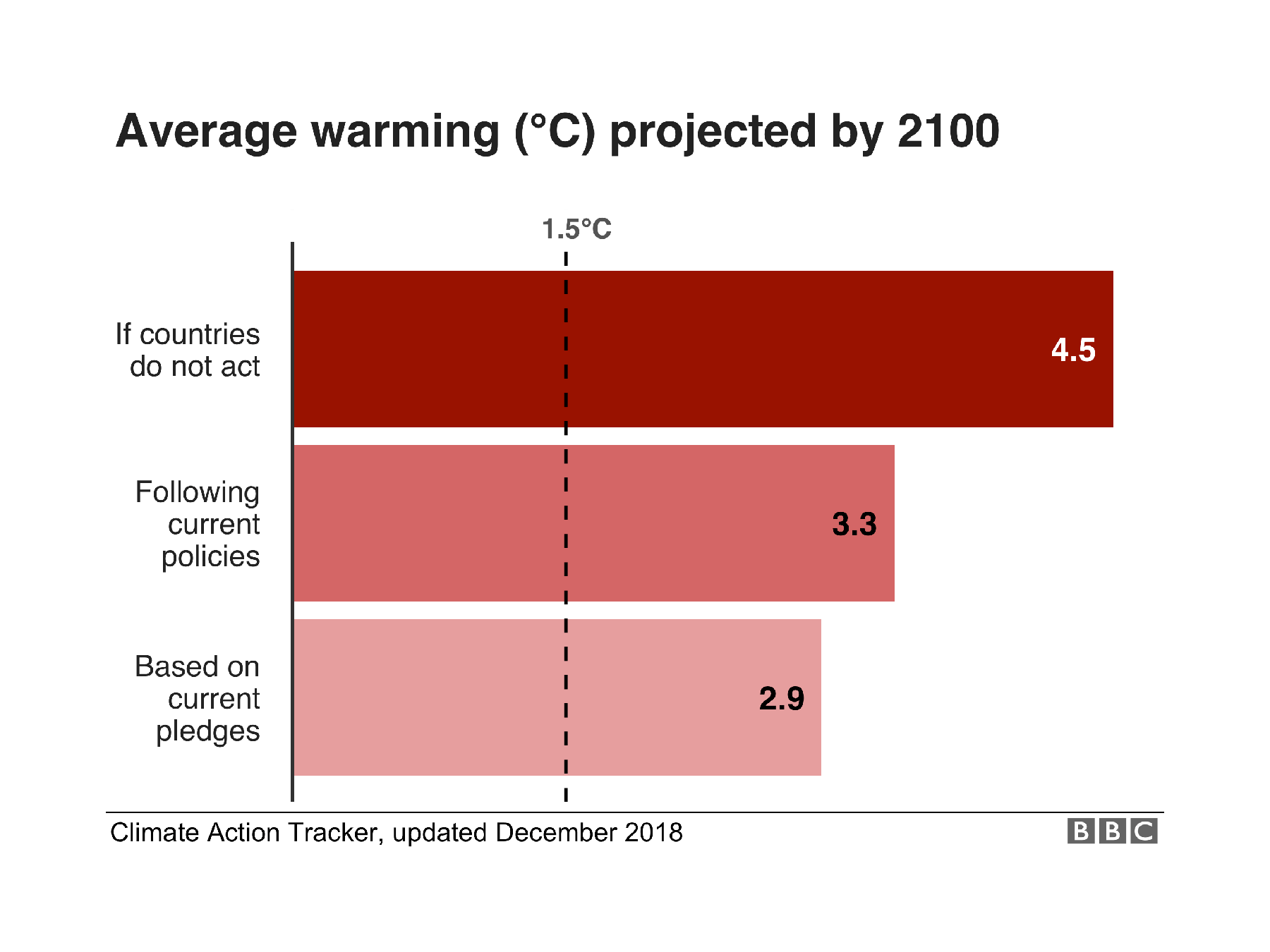

Global emissions of greenhouse gases are still rising rapidly and the window of opportunity to limit the increase in average global temperatures to less than 2 degrees is vanishingly small.

What Went Wrong

EU carbon prices have been far too low to stimulate investment in low carbon technologies and efforts to establish a global carbon market have largely failed.

New Economy in Progress

Putting a price on carbon will not in itself lead to a zero-carbon economy: it will require large-scale public action and investment to create the necessary markets and infrastructure.

5 WAYS THAT ARE DISCUSSED TO GREEN PROSPERITY

AVERAGE WARMING (°C) PROJECTED BY 2100

Climate policy in crisis – will better timing help with CO2 pricing?

Climate Policy through Price Shocks? – Prospects and Alternatives

Climate policy and jobs - With Jonas Fluchtmann and Anke Hassel

The End of Capitalism? On Economic Growth, Energy Transition and Planned Economy

Tom Krebs on a US Inflation Reduction Act for Europe

What should modern climate policy look like? Why the US Inflation Reduction Act might be a good example.

Are Green Jobs Good Jobs?

We invited leading experts to our New Paradigm Workshop to discuss what the labor market in a climate-neutral world will look like.