Quick & New -

the New Economy Ticker

The latest news, debates, proposals and developments on new economic thinking at a glance.

A new study by Gechert and Heimberger (2022) conducts a meta-analysis on the empirical literature on growth effects of corporate tax cuts, examining 441 estimates from 42 studies on the topic. Taking the unweighted average, a corporate tax cut of 10 percentage points would be associated with an increase in growth rates of around 0.2 percentage points. However, the authors conclude that due to publication bias, insignificant results are not published, which translates into an asymmetric distribution around the true value. If one controls for this bias, one cannot exclude a zero effect.

Why Are Financial Markets So Complacent? – Article

Anatole Kaletsky, Project Syndicate, 01.08.2022

Markets and central banks confidently expect a comfortable new “Goldilocks” era for the global economy that will allow everyone to live happily ever after. But investors’ sanguine outlook rests on four cognitive biases.

The Covid-crisis and the socio-ecological transformation: challenges for fiscal policy – Policy Brief (German)

Sebastian Dullien, Achim Truger, Katja Rietzler, WSI Mitteilungen, August 2022

The Corona crisis and the socio-ecological transformation pose difficult challenges for German fiscal policy. On the one hand, there are massive additional public finance needs in the order of €600 billion to €800 billion over the next ten years; on the other hand, the federal government has ruled out fundamental reforms of the debt brake in the coalition agreement and does not envisage any tax increases.

The Wealth of the Germans – Article (Paywall,German)

Moritz Schularick, Charlotte Bartels & Thilo Albers, FAZ, 01.08.2022

Today, one per cent of German households own around 27 per cent of the total assets of all Germans. But what was it like in the past? About the history of wealth distribution in Germany.

The article is based on this study.

The European drama series – Article (German)

Philipp Heimberger & Lea Steiniger, der Standard, 31.07.2022

Is the ECB preventing the euro crisis from flaring up again? Whether its new bond-buying programme is suitable as an anchor of stability could soon be called into question: if countries in need do not meet the criteria for it.

More competition! – Article (German)

Carsten Hermann-Pillath, Frankfurter Rundschau, 22.07.2022

Economics denies its own mantra. Yet a self-application of the prevailing doctrine would be revolutionary: breaking down barriers to market entry for new ideas and curbing the power of academic interest groups.

A recently launched website by Martyna Linartas revolves around the issue of inequality. The aim of the site is to make the problem of inequality more visible to the public and to provide knowledge about it in order to tackle the problem and reduce inequality.

Click here to get to the webpage.

Dealing with inflation, really – Article

Jayati Ghosh, Social Europe, 25.07.2022

Jayati Ghosh bemoans the economics profession’s inability to think beyond crude analyses of inflation—and crude policies to stem it.

The debt brake becomes a security risk – Article

Thorsten Benner, Tagesspiegel, 24.07.2022

The CDU/CSU has declared the black zero a fetish; today, the traffic light government could fail because of the debt brake. That is not sensible, writes Thorsten Benner in a guest article.

The ECB turns the tables on panicky markets and policymakers – Article

Martin Sandbu, Financial Times, 24.07.2022

Investors and governments are being tested in the latest attempt to address the eurozone’s problems.

The investment drought of the past two decades is catching up with us – Article

Martin Sandbu, Financial Times, 20.07.2022

Despite 20 years of cheap credit, countries have failed to secure their future.

The regime at risk – macroprudentialism faces the test of inflation – Analysis

Adam Tooze, Substack, 16.07.2022

With the fight against inflation taking center stage, the talk now is of the risks involved in slowing an economy hard. It is a test not just of particular policies and policy-makers but of a policy regime.

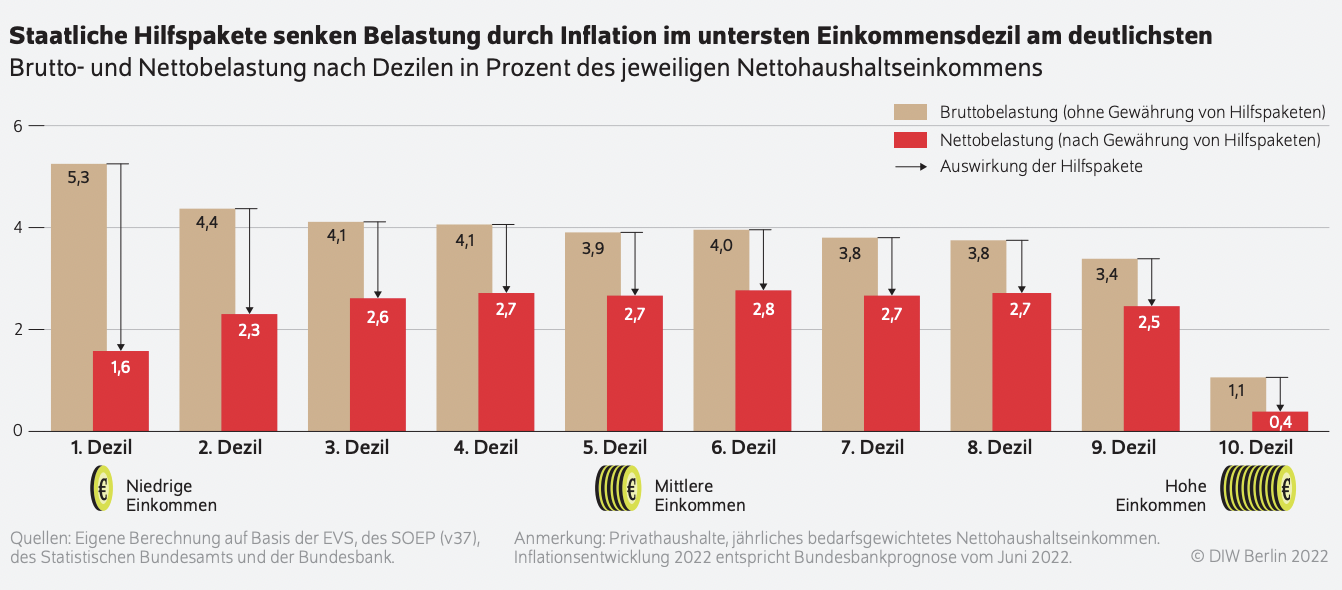

A new study by the German Institute for Economic Research (DIW) examines the burden on German households across the entire basket of goods along the income distribution on the basis of the Income and Consumption Survey and SOEP.

The authors come to the conclusion that the lower the income of households, the more the price increase burdens them. Moreover, the aid packages would relieve the lowest income decile in particular, while the lower middle class would continue to be significantly affected by price increases. Should inflation continue to rise in the second half of the year, low-income households in particular would be at greater risk of poverty.

An extensive summary of the study is available here.