NEW PARADIGM

Is the race to the bottom of corporate taxation finally coming to an end?

Yellen's call this week for global minimum corporate tax buries a weighty part of the old paradigm - the unhealthy tax competition between states.

BY

XHULIA LIKAJPUBLISHED

9. APRIL 2021READING TIME

2 MINAfter the impasse of last June 2020 in the talks for an agreement on a global digital tax plan with the former head of U.S. Treasury Steven Mnuchin, the renewed call for working on an international taxation plan comes from the same U.S., but with a new Treasury Minister and a much different approach and willingness to cooperate.

Janet Yellen is now openly advocating for the world´s biggest corporations to pay their fair share of the taxes to national governments and calls for the introduction of a global minimum corporate tax. This is part of Biden´s administration strategy to ensure revenues for backing the two-billion infrastructure plan recently announced and a move that would certainly put a break to the race to the bottom in corporate taxation that we have been witnessing over the last two decades.

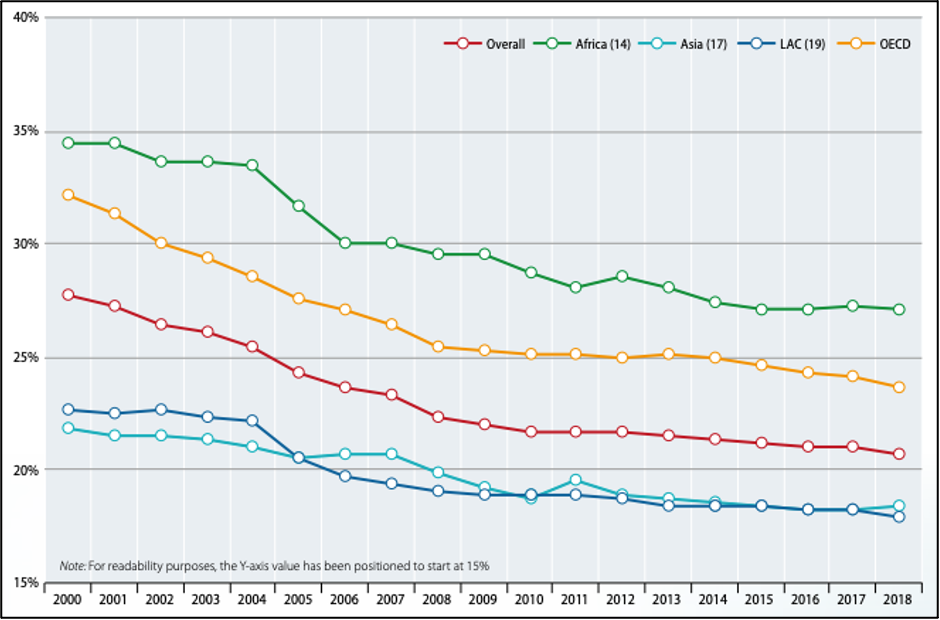

According to OECD (2019) the average statutory tax rate fell by 7.2 percentage points, from 28.6 % in 2000 to 21. 4 % in 2018. The decline has been even more acute in OECD countries with a drop of 8.5 percentage points. The insurgence of tax havens – countries offering low corporate tax rates that have attracted large multinationals in recent decades – fuelled the trend of declining corporate tax rates in other countries too, who wish to attract businesses in their national territories. The figure below gives a clearer picture of such trends.

The proposal coming from the U.S. seems to have been received with favor by many EU leaders, including Italy´s Mario Draghi, and bears the chance of winning the support of other large OECD countries.

The wind of change in and from the U.S. continues to blow. With a multi-billion rescue plan in the pocket, the recently announced infrastructure plan, and the call for a joint regulation of the international tax system Biden seems to be paving the way – step after step – to a new paradigm; one that certainly does not include old-days deregulation and tax cuts.