IX New Paradigm Workshop - A new economy, where are we?

27/October/2021

09:00 - 19:30

PLACE

Online Event

LANGUAGE

English and German with translation

Forty years after the beginning of the age of Reaganomics, a new era seems to have begun in the USA. A major paradigm shift has begun in once brand-liberal institutions like the IMF. In economics, there are new schools of thought. And even in Germany, with the prospect of the new government, the potential seems to be there for something fundamentally new. All this is enough for us to make a stop on the way to a possible new paradigm at our IX New Paradigm Workshop on 27 October 2021.

An overview of all sessions and key takeaways – written and as video.

The first session of our IX New Paradigm Workshop aimed at providing an update on new economic thinking in three areas: i) on the role of the state, ii) on a modern climate policy, and iii) on new fiscal rules.

i) On the role of the state

RAINER KATTEL explained the emergence of a new way of thinking about innovation policy and the paradigm shift away from hands-off approach towards a greater role for governments. He highlighted two areas of particular concern for mission-oriented policies: greening of finance with the aim of decreasing climate-related risks and rethinking competition policy with the aim of stopping digital value extraction. Looking at the past, much of innovation policy was due to military and security needs and did not sufficiently address people’s everyday needs (“the moon and the ghetto paradox”). Going forward, innovation policy must be implemented in an inclusive manner by engaging with the wider public and with a holistic approach by factoring in the effects on all relevant sectors.

In his comments, PHILIPP STEINBERG (BMWI, BERLIN) agreed that a green transformation of the economy is needed and explained that his ministry is working on expanding green procurement and improving competition law. In his view, (neo)classical arguments can justify market intervention in case of market failure. Referring to the idea of an “entrepreneurial state”, he said that he would not go as far as that but rather to choose the term of a “transformative state” that implements certain mission-oriented policies with a common European interest.

ii) On a modern climate policy

According to TOM KREBS, the cornerstone of a modern climate policy should be increasing public (infrastructure) investment, especially in the fields of transport and energy as this will generate green growth and create jobs. Debt-financed public investment projects including in the railroad system, energy grid, hydrogen pipeline system could make economic sense due to their high (social) returns. He explained possible ways of financing public investments necessary to achieving net neutrality by 2045 which would be compatible to the German debt brake.

In her comments, KATHARINA BOHNENBERGER steered the conversation towards the scale of economic transformation necessary to get the world on track to the 1.5 target: a rapid fossil fuel phase out or “exnovation” of the brown energy sector, while at the same time tackling the issue of social inequality in general and energy inequality in particular.

iii) On a new fiscal paradigm

During the pandemic, EU member states accumulated large public deficits, which is why some EU member states (especially the frugal four) are calling for a swift return to fiscal rules. Other are warning against repeating the mistakes from the EU sovereign debt crisis, namely cutting budgets too early in the recovery. CATHERINE MATHIEU presented the current academic discussion on alternatives for the existing and somewhat arbitrary fiscal rules at the EU level (60% debt/GDP, 3% deficit/GDP, 0.5% structural deficit/GDP). Most of the proposals center around an rule that limits public expenditure. Another approach proposed by Blanchard et al (2021) would be exchanging fiscal rules through fiscal standards, monitored by newly created independent fiscal institutions. However, these would have to make their decisions on the basis of stochastic estimates of the probability of sovereign insolvency, which is fundamentally associated with high uncertainty. Therefore, Mathieu and Sterdyniak (2021) suggest a new fiscal paradigm: members should be allowed to run a government balance consistent with their macroeconomic needs and agree to an open coordination in which they should target growth, full employment, and the ecological transition. This new paradigm should be based on trust between member states.

CHRISTIAN BREUER framed EU fiscal policy in terms of a cost benefit analysis. While the costs of prohibiting countries from pursuing stabilization policies are often overlooked, the low interest rate environment provides a good argument in favour of relaxing the fiscal rules. He brought up the question which role countries such as Germany could play in reducing their excessive current account surpluses.

Now that the COVID-19 pandemic has highlighted anew the flaws of economic deregulation and market liberalization, a new policymaking paradigm seems to be emerging. In a report released recently, the G7 Economic Resilience Panel demands a radically different relationship between the public and private sectors to create a sustainable, equitable, and resilient economy. Panel members, among others, include IIPP director Mariana Mazzucato and French economist Thomas Philippon.

In preparation for our IX New Paradigm Workshop on October 27, we had the opportunity to speak with the German envoy for the G7 Economic Resilience Panel, Stormy-Annika Mildner, about the process leading up to the G7 report, and the panel’s attempt to develop a new economic consensus, which was modelled (in spirit, not content) after the famous Washington Consensus that determined global economic policy making for almost a half-century. Said new econ-political vision, as proposed by the G7 Economic Resilience Panel, is the so-called Cornwall Consensus. It sets out seven priorities for public-private investment, global standards and better governance, including on health and climate change.

As Stormy-Annika Mildner explained in her discussion with us, the G7 Economic Resilience Panel was originally initiated with a strong focus on increasing resilience of global supply chains. However, the massive challenges and insufficiencies encountered with the old economic paradigm during the Covid crisis, led the group to consider economic and social resilience in broader terms.

At the core of the Cornwall Consensus is the idea to carve out a new pact of solidarity, says Mildner; and the understanding that openness and liberalization don’t automatically lead to wealth and prosperity but should be accompanied by government policies reflecting concerns of well-being, inequality, protectionism and climate change.

Key recommendations made by the panel include an intensified cooperation among countries through enhanced channels of communication and official playbooks to not only exchange data on shared vulnerabilities, but also bundle efforts to enhance the quality of investments. An example brought up in the report, and stressed in our conversation with Mildner, is the recommendation to initiate a CERN type mission-oriented research center that can incubate climate innovations and pool pooling public and private investments aimed at decarbonizing the economy.

Additionally, the panel recommends that existing governance structures and standards be adapted to the realities of the 21st century, and socio-economic progress be considered in broader terms than growth and GDP.

At the outset of this panel, DIANE COYLE provided evidence on the “applied turn”, i.e. steady overtaking of microeconomics as a field in economics measured in the number of academic publications. The lack of diversity at economic university departments leads to an unconscious bias in economic modelling and in the application of statistical methods, which indirectly promotes data bias in artificial intelligence. The core assumptions on society and markets, including but not limited to the “homo oeconomicus” assumptions, are distorting the reality and resulting in a tendency towards relying on markets for solving economic and social problems. In her book “Cogs and Monsters: What Economics Is, and What It Should Be” she recommends working more closely with other disciplines and other methods, returning to the political economy and rebooting welfare economics.

MICHAEL JACOBS presented the different aspects of a politico-economic paradigm. Every paradigm needs concrete political goals, supporting economic theories and successful ways of shaping the public discourse. In his view, we are in the historical equivalent to the 1930s Great Depression – a time in which the policy prescriptions of the prevailing paradigm have failed but a new economic thinking has not yet taken hold. Among those obstacles are the insufficient communication between so-called mainstream and heterodox economic schools of thought and the general lack of translation of economic ideas into the broader public debate. He suggests replacing economic growth as the main objective of policymaking by a new set of goals including environmental sustainability, improving wellbeing, reducing inequality and financial system resilience.

A lively discussion ensued on the central assumptions in economic models and the extent to which they should be rethought. MICHAEL JACOBS and DIANE COYLE both stressed that the core problem of the baseline model is the assumption of an “ideal world” in the baseline model when so-called externalities are actually fundamental factors in the economy. MAJA GÖPEL highlighted the need for a reckoning why decoupling has failed so far, including by taking a closer look at rebound effects. She also underlined the importance of better quality of data and indicators (e.g. for biodiversity) in gearing the systems change in economics towards better accounting for complexity.

JAKOB VON WEIZSÄCKER agreed that trying to solve the economic problems of the 21th century with 20th century economic reflexes will simply fail. Thus, economist should be more curious and self-critical, avoid ad hominem arguments within the profession and focus on offering new solutions. In his view, we are still in a “pre-paradigm phase” and are not yet in the position to present a viable alternative. According to JENS SÜDEKUM, the baseline economic growth model has been quite flexible, e.g., in embedding the financial sector. On this point, ANTONELLA STIRATI expressed more caution, highlighting some of the inconsistencies in economic models. She raised the question whether the current paradigm shift would last, and to which extend the “old” thinking (e.g., as manifested as EU fiscal rules) would change, particularly in case of a reversal of the low-interest rate trend.

The second knowledge base update session of the IX New Paradigm Workshop aimed at providing an update on new economic thinking in three areas connected to inequality: i) on (wealth) inequality, ii) on financial markets through the lens of inequality, and iii) on populism.

i) On inequality

When talking about inequality, the question always is: inequality of what? In the German context, CHARLOTTE BARTELS emphasised the importance of wealth inequality, which has risen most significantly since the unification. However, policy has so far still been concerned with (labour) income inequality. Whereas policies such as the minimum wage are prominently discussed in the coalition talks, a wealth tax seems to be from the table. She made the case for a shift towards policies against wealth inequality, differentiating between two kinds: 1. Revenue side: tax the rich. 2. Expenditure side: support wealth accumulation of the poor.

In her comments, CARMEN GIOVANAZZI stretched the importance of business wealth for wealth inequality. She also agreed that the wealth effects of rents and real estate are especially concerning. Taking the referendum for the expropriation of large real estate companies in Berlin as example, she argued the majorities for policies against wealth inequality are there, but it seems to be a problem of the political decision making process to implement them.

ii) On financial markets

In his talk about new economic thinking in the realm of financial markets, MORITZ SCHULARICK stressed three points.

1. The promise of the 90´s that financial liberalization will lead to stabler financial markets due to higher risk sharing capacities, higher efficiency at capital allocation and, thus, higher growth proved to be wrong. Seemingly, during Covid-19 policy makers have learned from the financial crisis and central banks have extended their mandate of lenders of last resort in unprecedented magnitude (with good justification).

2. Together with the rise of heterogeneity in economic models, the assumption of the old paradigm that monetary policy in neutral has been challenged. A lot of research is focussed on the distributional effects of monetary policy. There is no consensus about the direction of the effects, but one thing is clear: central banks do not live in a world of a divine coincidence – stable inflation does not automatically lead to high growth.

3. But not only the effects of monetary policy on inequality are investigated, but also the reverse effects. There is also research about how shifts in income inequality affect saving rates, which might have played a role in the decline of the interest rates.

In her comments, DOROTHEA SCHÄFER highlighted that central bank policies have twofold effects on inequality. One side of the coin is that asset owners – mostly on the top of the wealth and income distribution – have benefitted by central bank purchases. On the other side, highly indebted households have also benefitted from low interest rates, as have lower income households by employment effects.

iii) On populism

A topic closely related to inequality was discussed in the last part of the session, namely populism. ROBERT GOLD interpreted populist votes as opposition against structural change, which in the light of the huge changes to come due to climate policy underlines the importance of this topic. He stretched that redistribution alone is not enough in fighting populism, as people face more than monetary losses. One way could be to not take technological change as exogenously given, but shape it, as suggested by Joe Kaeser on our workshop in May.

In his comments on how to deal with populism, GUSTAV HORN talked about the elephant in the room: uncertainty. Due to many reasons also named in the previous talks, such as wealth inequality, heterogeneity, or Covid-19 uncertainty has risen. He argued that policy measures beyond redistribution should be built around respect.

For new ideas to spread, narratives are crucial. But is there a narrative for a progressive paradigm around? With this question, the moderator ULRIKE HERRMANN started the session on narratives.

Narrative economics is prominent, since Robert Shiller laid his focus on the explanation of narratives for economic outcomes. MICHAEL ROOS presented his theoretical framework on narratives and presented two examples from the economic sphere about the genius Elon Musk, and the rule based approach of Ben Bernanke.

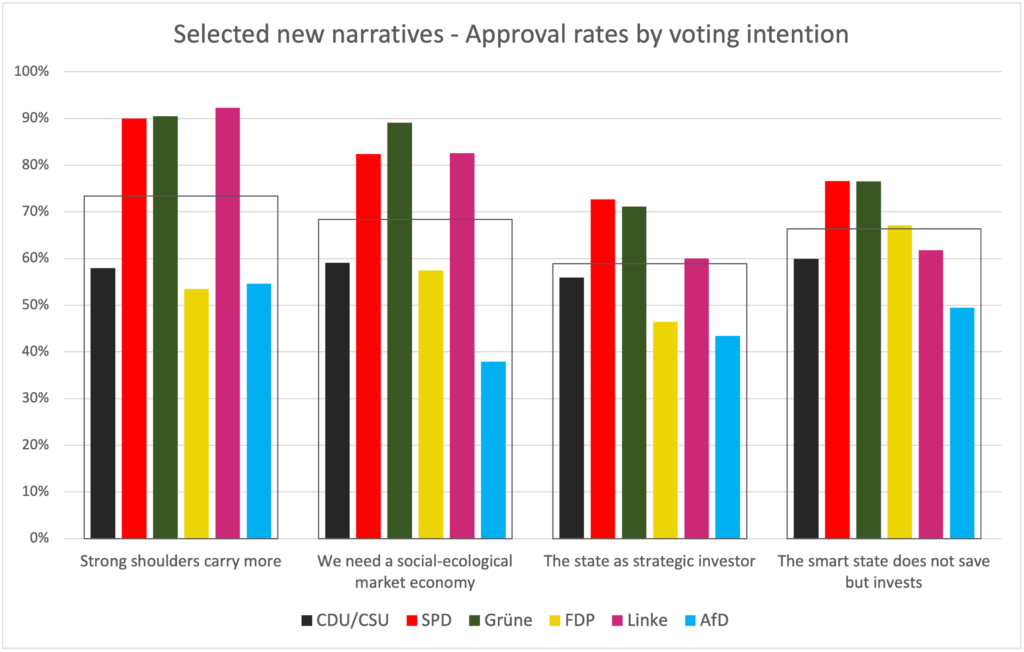

More from a practical point of view, THOMAS FRICKE presented a study on narratives in the election programs for the German federal election. Narratives for a new paradigm seemed to be neck-and-neck with narratives of the old market liberal paradigm. He concluded that the new narratives are not yet sufficiently convincing to overtake the old.

In his talk, ANATOLE KALETSKY stressed that the reality is not foreseen by narratives by the example of the fear by many economists after World War II of an era of depression and recessions. Hence, the fear of a stagflation revival might be unnecessary. Also he emphasised that in economics it is really the time for a new paradigm.

WILLIAM LAMB talked about narratives in the context of climate change. More precisely, he talked about the climate change counter movement, preventing climate policy through the propagation of climate denial discourses.

Together with NEF, FrameWorks Institute and PIRC, NEON (New Economy Organisers Network) has recently published a report called ‘Framing the Economy’, which sets out how progressive forces can tell a new story to help accelerate the shift to a new economic system. For our IX New Paradigm Workshop, we asked their head of messaging, Dora Meade, to share some practical insights from the report with us, followed by a discussion with political economist and climate activist Tadzio Müller.

As Meade explained, the 2-year project identified three central elements of narrative development: forging a common agenda (defining a vision), understanding the audience, and mapping the gaps (to define opportunities for story telling). In the UK, where the ‘Framing the Economy’ project was undertaken, the researchers from NEON were able to identify that most people think of the economy as a ‘container’ that things go into, and flow out of. Thinking of the economy as a container resulted in a people being split into two opposing camps: takers and contributors. Additionally, it led to people to feel a sense of detachment from the workings of the economy which they thought should best be left to experts, or itself.

From these findings, NEON and their partners were able to identify a number of priorities for narrative development. Firstly, rather than talking about the economy in an abstract sense, it is more important to emphasize the conditions it is creating for every member of society. Secondly, rather than leading messaging with what’s wrong in the world, progressive narratives should first lead with the value of interdependence – the idea, that we all rely on each other in a collective manner under the umbrella of socioeconomic activity.

Tadzio Müller added that a narrative is only as powerful as the set of practices connected to it. Especially climate change and inequality narratives to date lack appealing narratives that can spark political action against the hard to convey context of economic boundaries and global economic debt.

In her new book “What we owe each other – a new social contract” , Minouche Shafik sets out how profound changes in technology, demography and the climate crisis have put pressure on the existing social contract and argues that the current crisis provides an opportunity to redefine it.

MINOUCHE SHAFIK explained that the 20th century social contract is broken. It was based on the concept of clear division of labour within families with a sole breadwinner who oftentimes enjoyed steady employment with fixed benefits. Female emancipation, digitalization and ageing have been influential factors in changing the economy. With the notion of a social contract, Minouche Shafik refers to a set of norms and rules that define who we live together. In her view, discussions about redistribution measures fall a little short. She emphasizes the need to optimize the system of intertemporal distribution, i.e., that people contribute with their taxes as adults in return for being looked after before they enter and after they leave the workforce.

Nowadays, labour markets are highly flexible with the result that the share of informal work amounts to nearly one-third in advanced economy. Improving working conditions will require a minimum of social security for all, including minimum wages, basic health care and access to education. Although there have been strides in gender equality, women still carry the brunt of early years education and everyday household labour. Moreover, efforts in empowering all minorities and less well-off families are urgently needed. Many industrialized countries such as the US, the UK and Germany have seen a drop in social mobility. According to Shafik, education is a key area in addressing this issue, which is why she proposes more public investment into early childhood education and lifelong learning.

While all of these considerations also apply to the notion of welfare, the new social contract goes beyond expanding the welfare state and also includes the private sector. One way in which business could be better included in sharing societal risks and rewards would be increasing corporate taxes and in turn providing more publicly funded support for employment benefits (such as parental leave) and a minimum pension. Her overall concept of “predistribution” is meant to combine economic and social policies with the aim to share risks better and collectively but are also in a politically and economically feasible manner.

In his comments on the book, XAVIER RAGOT added the issue of intergenerational and global solidarity. He suggested defining the “we” in “we owe each other more” more broadly. As an example, he mentioned the EU SURE (Support to mitigate Unemployment Risks in an Emergency) project, which could present a small step in creating a European welfare state. He also alluded to the difficult political path ahead for increasing risk-sharing, especially climate risk, within and between countries.

Since taking office, Joe Biden has made headlines with his $1.9 tr. Covid relief bill, which he now wants to top with an additional $1.2 tr. in physical infrastructure spending and $3.5 tr. in social infrastructure spending, which taken together represents one of the largest fiscal stimulus packages in American history. In contrast to other stimuli issued in the past, Biden’s packages are designed to the benefit of low- and middle-income classes through a miscellaneous of measures, including direct payments, extended unemployment benefits, funding for schools and childcare services, and an expansion for Medicare.

Is all of this enough to claim that Joe Biden has kindled a new era in policymaking? And does Bidenomics have potential to stimulate change in other economies, even in fiscally conservative countries like Germany? This was the guiding question of the final session at our IX New Paradigm Workshop with Berkeley professor Barry Eichengreen, director of IMK Sebastian Dullien, and Michael Burda from HU Berlin. The session was moderated by Nicola Brandt, head of OECD Berlin.

According to Barry Eichengreen, Biden’s stimulus package rests on three major pillars: the belief that debts and deficits don’t matter the way they used to, that a more expansive role of the state is warranted, and that the economy can and should run hot to stimulate aggregate demand and distribute benefits more widely. In fact, empirical evidence shows that wages in the US, particularly among the lower paid, have recently risen faster than inflation rates. The reasons for this include strong labor demand and labor labor force participation rates that remain below historic trends.

Biden’s proposed stimulus package has broad support among the American public, which has grown more conscious of rising inequality rates, unequal opportunities, and the importance of the government in crisis times like Covid. A recent Gallop survey indicated that Biden’s proposal is backed by 63% of Americans, including 36% of Republicans. According to Eichengreen, “this is as much support as we can get on anything in America”. A new paradigm in practice, then?

Eichengreen remains skeptical and warns that the congressional view, which overrepresents rural areas, legacy coal mining areas, and frontier areas (rugged individualism), does not reflect the broad public support of Biden’s proposed bill. While there is a paradigmatic difference between Trump and Biden, says Eichengreen, there remains a disconnect between public attitudes and congressional actions which, at least for now, may hamper a policy package that reflects a new public paradigm. Michael Burda agreed, saying that especially with regards to climate change, the US has not undergone a paradigmatic shift (yet). He sees potential to stimulate change through a EU or Chinese carbon border tax.

With regards to the question whether the US fiscal debates will spill over into German debates and influence policymaking, Sebastian Dullien sees mixed potential. Some elements of Bidenomics, in particular the importance of additional physical infrastructure investment, he says, may well motivate political action in Germany, where a majority across all Bundestag parties for stronger physical investment already exists. Aspects of the debt debate may also influence discussions in Germany, but Dullien expects this process to be rather slow due to the constitutional element of the debt brake. In contrast, he expects the rather panicky inflation environment in Germany to prevent a running hot of the economy anywhere near the extent of Bidenomics.

Whether Bidenomics can blossom into a paradigmatic change remains to be seen over time and will largely depend on whether political decisions will evolve to mirror public attitudes more closely.