GLOBALIZATION

The Fall of the Wall and the “Schwarze Null” – Understanding Germany’s Surplus

Review of Chapter 5 in Michael Pettis' and Mathew Klein's “Trade Wars are Class Wars”.

BY

MARC ADAMPUBLISHED

6. AUGUST 2020READING TIME

8 MIN

There is hardly a new day without news about the deteriorating U.S.-China diplomatic relationship. Four years after the 2016 U.S. presidential election we know that much about the electoral outcome had to do with what is now widely dubbed as “the China shock”.[1] The massive current account surplus that China generated every year over the course of two decades was an important factor in turning the region in the North East of the United States, once an industrial powerhouse, into a hotspot of the dramatic opioid crisis. Once that is being acknowledged, one can reasonably argue that Donald Trump is simply trying to fulfil his campaign promise to the white working-class electorate that pushed him into office. But Klein’s and Pettis’ (K&P) brilliant contribution to the literature that seeks to explain the recent populist backlash to globalization around the world is that they go beyond the inner economic and political developments of deficit countries. Instead, the authors put much responsibility on surplus countries. Their hypothesis is aptly captured by the provoking title “Trade Wars are Class Wars”. Or to restate it in a slightly less radical way:

The thesis of this book is that rising inequality within countries heightens trade conflicts between them.

Indeed, far from being solely about the U.S.-China trade war, the book seeks a general explanation for the recent drive towards nationalism and deglobalization. To exemplify their hypothesis, the authors dive into another case study: Germany. Although the current account surplus of Germany vis-à-vis the U.S. is relatively small compared to the one of China, this is not true for the European Union as a whole. And as Klein and Pettis convincingly argue, Europe is increasingly emulating Germany since the European debt crisis. From 2012 onwards, Europe adopted the German model that externalized its inner socio-economic problems to the rest of the world and once again the United States had to face “the exorbitant burden” to serve as a global consumer outlet of last resort.

To defend their hypothesis that rising inequality within Germany, exacerbated by false policy responses, contributed to the ills that are threatening our globalized world, the authors first take us back some 30 years to the fall of the Berlin wall. While the Tiananmen square massacre in 1989 upended the Chinese democratic movement and paved the way for China’s own way of economic and political development, the revolution in East Germany peacefully succeeded. In that sense, 1989 is a pivot point for both economies and the German reunification shock is analysed in depth, which is worth a read as we are experiencing its 30th anniversary.

The sections on the reunification process, which East Germany entered with a heavy load of foreign denominated debt and under the pressure of continuous emigration, are reminiscent of Germany’s insistence during the Eurozone crisis that crises torn countries need to undergo reform. The statements of Helmut Kohl in 1990 that “assistance can only prove effective if fundamental reforms of the economic system follow” or that West German taxpayers were not going to pay “to stabilize conditions that have become untenable” echo the sounds of 2012 – 2015 when Wolfgang Schäuble and the Troika took the stage in the Eurozone drama.

At times the reader is wondering whether there is a specific ideology inherent in the German way of economic policy making over the past 30 years.

Indeed, given the provocative title of the Book, the chapter title might as well have included a reference to Karl Marx’ and Friedrich Engels’ notorious manuscript “The German Ideology”. It is at the intersection of economics and ideology where chapter 5 is most breathtaking, but also leaves the reader with an open question. What is the causal mechanism that squeezed consumer spending power, increased corporate profits and finally the German current account surplus? Does ideology influence the economic outcome or is ideology itself determined by changes in the economic system? In a recent discussion with Adam Tooze, Matt Klein argued “that it’s a mix of all of these factors. There was an ideological component, and it’s very hard to understand why the choices were made without that, but there were other forces as well.“[2] What Klein and Pettis ultimately seem to suggest is that it’s changes in the distribution of income and wealth that are the main driver, not only of particular economic outcomes, but of the governing economic paradigm as well. As Marx and Engels argued back in 1846: “The ideas of the ruling class are in every epoch the ruling ideas. “

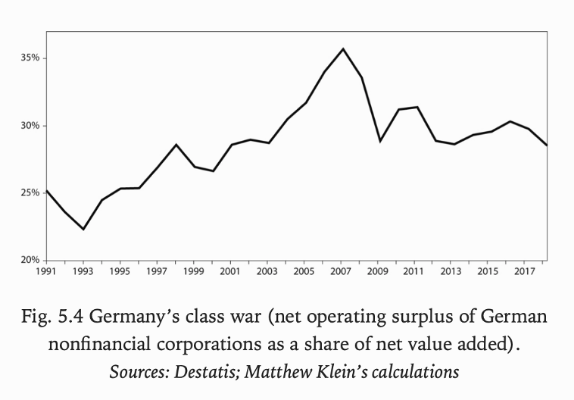

Their main piece of evidence of the class war hypothesis is personified by Peter Hartz, the mastermind behind the notorious Hartz reforms that cut German welfare spending. But what K&P argue is that “[t]he impact of Hartz IV itself is often overstated. Germany’s meagre wage growth and underinvestment were consequences not of welfare cuts, but of choices made in the 1990s by German elites.” Instead, Peter Hartz personifies K&P’s class war hypothesis so much because he had been Head of HR at Volkswagen since 1993 and thereby was part of the export-oriented elite that had pushed for wage cuts throughout the 1990s. The argument is best illustrated in their figure 5.4, which shows that between 1993 and 2007 shareholders appropriated more and more of the net value produced by non-financial businesses.

Yet, K&P also show that frequently between 1991 and 2007 the German government was constrained to expand spending by institutional structures that have their origin elsewhere. After the short reunification boom, the German government cut spending on infrastructure investment and maintenance by 20 percent between 1992 and 1998. K&P attribute this shift to Germany’s relentless commitment to the Maastricht Treaty of 1992, which provided an iron deficit rule. In 2001, when Germany entered a recession after its short-lived tech boom, the new common European currency prevented Germany from lowering its interest rate. At the same time, the German government was constrained to borrow and boost spending. This time the newly created Stability and Growth Pact (1997) constrained the government budget on top of the Maastricht Treaty.

These factors are hard to explain by increasing inequality within Germany. They can’t even be fully explained by increasing inequality within the Eurozone as a whole, since similar policies were pursued in the UK, the U.S. and elsewhere. They have to be explained by an economic paradigm that dominated all western economies. This paradigm could certainly have been shaped by the ruling class, which became more powerful as inequality increased and K&P convincingly argue that this might indeed be the case. Yet, inequality has been trending upward for at least 10 years before 1989. Whether this initial shift was caused by changes in taxation, financialization or globalization, ideology or economics, remains to be solved.

Overall, K&P provide a convincing narrative that increasing inequality within the industrialized nations is responsible for the nationalist backlash today. Both, the book as a whole and the chapter on Germany in particular are highly recommended for anyone who wants to understand the global political tensions today.