EUROPE

German-French alternative to Euro-Bonds

What's behind Merkel and Macron's 500 billion-dollar proposal. Our update on the reconstruction plans for Germany and Europe.

BY

THORE BECKMANNPUBLISHED

19. MAY 2020READING TIME

2 MINIt is well known that the EU works best when Germany and France pull together. With the new proposal for a 500 billion euro recovery fund, Berlin and Paris are sending a positive signal to the EU countries in crisis. Now it’s time to convince the other EU 27 countries of the proposal. On Tuesday the finance ministers of the countries will already discuss the details of the proposal. Especially the Netherlands, Austria and Sweden will have to be convinced.

Nevertheless, the experts seem to agree that this could be a crucial moment for the EU.

Big day for 🇪🇺. Has Hamilton arrived in the form of the 🇩🇪🇫🇷 proposal? We will follow up on Wednesday with a discussion of the financial future of Europe joint with @LauBooneEco @gilliantett and @adam_tooze https://t.co/lLVv7UTFNd

— Moritz Schularick (@MSchularick) May 18, 2020

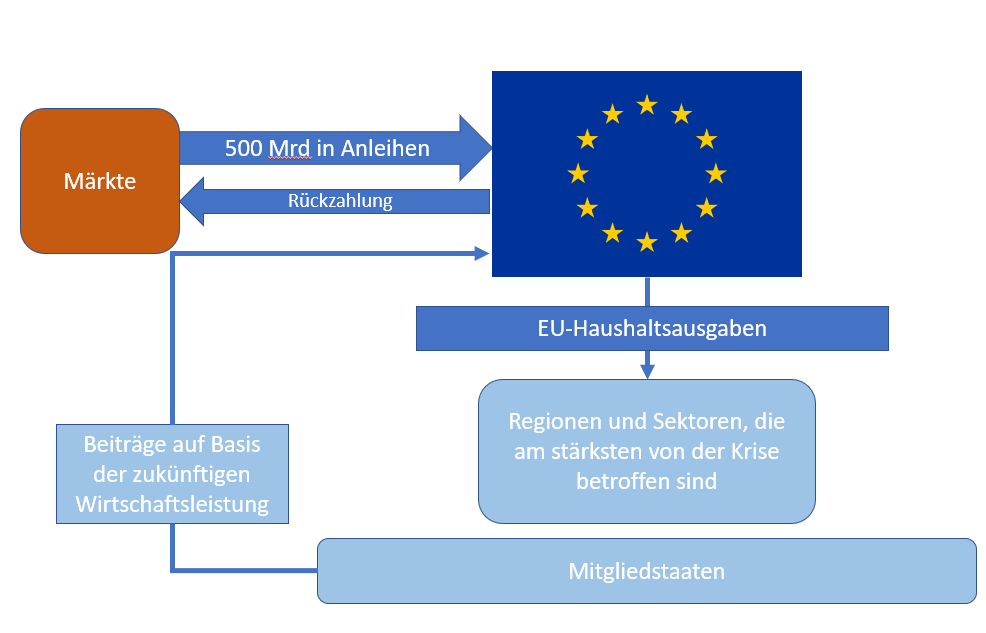

🇩🇪🇫🇷 propose 500bn in EU budget spending, skewed towards the most affected, re-distributive (get according to need, pay according to GNI key), financed by what is effectively federal issuance integrated in MFF. That’s bigger than Karlsruhe. #HamiltonDreamhttps://t.co/5vU2qYXXog

— Silvia Merler (@SMerler) May 18, 2020

Lucas Guttenberg (Jacques Delors Centre) is enthusiastic about the simplicity of the proposal, but wonders to what extent it is possible to ensure that the money gets to the right places.

The New York Times meanwhile speaks of a “Major Step” for European cohesion and notes positively that Merkel breaks the German taboo of common European debts and thus leaves German economic orthodoxy behind:

New York Times: Merkel, Breaking German ‘Taboo,’ Backs Shared E.U. Debt to Tackle Virus

But not everybody is as enthusiastic about the new proposal. In a recent twitter thread Sony Kapoor relativizes the historical magnitude of the proposal.

Coming late to the story but I can’t be the ONLY one thinking the “Hamiltonian” “Game-Changing” [insert your superlative here] Franco-German #RecoveryFund proposal is in fact neither “a Hamilton moment” nor Game-Changing nor, in fact, even adequate … “Much Ado About Not Much”

— Sony Kapoor (@SonyKapoor) May 20, 2020

***

Here you can find the press release on the joint proposal of the Federal Government and a first assessment by the Financial Times:

Press release of the German Government

Financial Times: Germany and France unite in call for €500bn Europe recovery fund